We cannot change the tax regime. But we can make the most of it for you.

Please be aware the below blog is older than 12 months, therefore the information may not be relevant or up to date.

There is a big difference between money in your limited company and money in your personal account. Income that your company makes over and above its costs are generally called profit. However, for a small business of one or two shareholders/directors, this money can be extracted from the company in a number of ways, just one of which is profit.

For example, you could increase your wages or pay yourself a bonus. However, the taxation you would incur doing this is very high. The most popular extraction route is via a minimum wage, up to the personal allowance limit for tax and National Insurance (NI) and dividends for the balance. A major issue with this method is that whilst tax is lower than wages and bonuses, you need to show a profit: many companies don’t know what this will be until the end of the company accounting year. Over the pandemic, many directors were caught out by this. Having been used to taking monthly dividends, they discovered at the end of the accounting year that they did not have enough profit, so had to repay the surplus dividends or pay a large tax penalty.

Exploring the options

The tax burden on small owner-run businesses has increased significantly over the last few years, with increases to NI and corporation taxation. So, I always explore other cash extraction methods to reduce the tax burden on the small owner-run limited companies I advise.

The first option to consider, although many have already done this, is to split the shareholding with a non-/low-tax paying spouse. This can potentially double your tax allowances. A company making £100,000 pa, for instance, could save £20,000 pa in tax.

If you’re a director/shareholder and you don’t need the income/profit right away, it may be tempting to leave the money in the business to avoid paying tax. However, this causes additional issues:

Firstly, you will still have to pay corporation tax on it. Currently, this is a flat 19%. From 2023-2024, this will be 19% on profits up to £50,000 then 25% on profits over £50,000. So, from next year, a £100,000 profit left in the company will incur an extra£3,000 in corporation tax.

Secondly, HMRC does not generally like cash to be held within a business without a specific business purpose. Large cash amounts, of more than 20% of assets, are unlikely to qualify for IHT relief if a shareholder dies. If you hold over 50% of assets in cash when you die, you could be in danger of failing HMRC’s complex “wholly and mainly” test – meaning the whole business could be excluded from the IHT relief.

Thirdly, cash held in a business is unlikely to get a very good interest rate from the bank. And with inflation where it is, that means your cash will be reducing in real terms.

Pension potential

But there is a smart solution to this conundrum. If you find yourself not needing all the income straight away and are over 55, then you can use pensions to your advantage. Money paid into a pension by a company is paid and charged to the business as a business expense, just like paying the rent or buying materials. With 25% of the pension payment being tax free, you could pay £40,000 pa into your pension (the full annual pension payment allowance) then immediately take out £10,000. That would give you tax-free cash to spend now and leave £30,000in the pension until you retire.

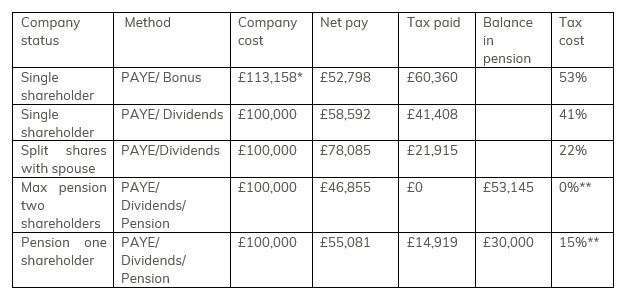

The table below shows the net pay and taxation based on £100,000 for the various extraction methods for the 2023-2024 tax year.

Note *for PAYE/ Bonus the company cost is higher as the company will also have to pay NI on the payments.

** Income tax may be payable when the pension is accessed.

The single shareholder pension option provides net pay £3,000 pa lower than PAYE/dividends - yet will create a £30,000 pension pot each year.

The max pension two shareholders option provides a lower income today but stores away over £53,000 in a pension for the future, making it well worth considering for directors that don’t really need that much income today.

Ginkgo Financial can create a bespoke extraction method using more or less pension as needed to ensure you obtain the income you need today and create an income for the future. We cannot change the tax regime. But we can make the most of it for you.

By Daren Wallbank

Tax treatment varies according to individual circumstances and is subject to change.

The value of pensions and the income they produce can fall as well as rise. You may get back less than you invested.

Tax planning and tax advice is not regulated by the Financial Conduct Authority.