Pensions

The freedom to be who you want to be

Wealth

Planning to realise your dreams

Protection

A buffer from life's blows

Succession

Preserving wealth for your loved ones

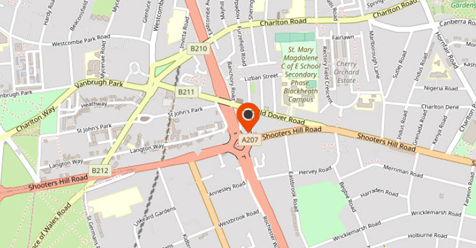

FINANCIAL ADVICE IN LONDON

Our Specialisms

-

Final Salary Pensions

Finding the right advice on pension transfers can be intimidating....

VIEW MORE -

Alternative Investments

An alternative investment is an investment in any asset class excluding stocks, bonds, and cash...

VIEW MORE -

Estate Planning

Preparing for the inevitable is one of the kindest things we can do for loved ones.

VIEW MORE

WORKING WITH YOU

WORKING WITH YOU

Plan towards your goals with Ginkgo Financial

Many people have goals and dreams, but a goal without a plan is just a wish... an achievable goal is a dream with a deadline.

-

Why use a financial adviser?

Few people think twice about using a solicitor or accountant when they need specialist professional advice. We believe that working with a financial adviser should be no different.

-

Our Story

Ginkgo shares its name with an ancient tree with a story to tell. Its longevity reflects our long term commitment to helping our clients achieve their personal financial goals.

-

Working with you

Just as there’s no such thing as an average client, there’s no one-size-fits-all financial plan. We’ll work with you to agree an approach that matches your unique personal and business situation.

-

Contact Us

Give us a call or send us a message

CAN WE HELP YOU WITH ANYTHING?

Ask for a Call Back

Request a Call Back

Verified independent reviews

Read what our clients think

Review from Verified Client

***** 5 out of 5

What were the circumstances that caused you to look for a financial adviser?

I co-own a production company and Daren has helped set up our pensions, insurances, investments and wills.

How did Daren help you?

He clearly explained everything we need and what we should invest in, he made it easy to understand and straight forward.

Have you seen the outcome you were hoping for?

We have seen a good outcome with Daren’s recommended investments and pensions.

Review from Verified Client

***** 5 out of 5

What were the circumstances that caused you to look for a financial adviser?

Pension, auto enrolment, insurance, shareholders protection

How did Daren help you?

Daren is extremely helpful, knowledgeable and approachable. He talked us through all the processes and made everything understandable and straight forward. Really great customer service from the whole team too.

Have you seen the outcome you were hoping for?

Absolutely

Review from Verified Client

***** 5 out of 5

What were the circumstances that caused you to look for a financial adviser?

I needed an income to pay for my wife’s care home costs.

How did Daren help you?

Daren has been a tower of strength and knowledge. He is extremely knowledgeable and has looked after all aspects of financial planning in turbulent times. I am very happy with the care and expertise given to me.

Have you seen the outcome you were hoping for?

He has maintained my income in difficult times. He has never over promised and under delivered.

Review from Verified Client

***** 5 out of 5

What were the circumstances that caused you to look for a financial adviser?

I had a sum of money that I wanted to invest and my wife had money invested that was not working well so she wanted to transfer the money to a Fund that would do better.

How did Daren help you?

He listened to our needs and wishes, made a thorough analysis of our finances and gave sound impartial advice on investment funds to see which system would work best for us. He is honest and talks clearly without any financial jargon, which is very reassuring.

Have you seen the outcome you were hoping for?

Yes. Our investments performed 400% better than my wife’s previous investment fund in just 12 months. Over the past 4 years of uncertainty over Brexit the funds have still performed well. The Pandemic caused a major slump in the financial markets but things are now starting to hopefully get back to normal now that Vaccines have been developed and in use in early 2021.

What could they have done better?

No financial systems could have performed in the past year due to the unprecedented events. Daren has been open and honest and could not have done more in the circumstances.

Review from Verified Client

***** 5 out of 5

What were the circumstances that caused you to look for a financial adviser?

Daren has been giving financial advice to me and my wife for the past years. His clarity and really good advice has been invaluable, especially from the moment George Osbourne freed up pension regulations.

How did Daren help you?

His unbelievable knowledge has kept all our finances in good order and is a rock in these choppy waters!

Have you seen the outcome you were hoping for?

Yes and more

What could they have done better?

His financial advice has been invaluable, especially with his unbelievable knowledge.