A financial adviser’s job is a little like being one of the crew on Odysseus’ boat. We know many investors are going to be tempted by the siren songs of an overzealous media - which is why we’re going to (figuratively) tie you to the mast to stop you making rash decisions.

Please be aware the below blog is older than 12 months, therefore the information may not be relevant or up to date.

We all know the story of Odysseus and the Sirens who tried to lure him away from his end goal of returning home. But how does it apply to investing during economic unrest?

A financial adviser’s job is a little like being one of the crew on Odysseus’ boat. We know many investors are going to be tempted by the siren songs of an overzealous media - which is why we’re going to (figuratively) tie you to the mast to stop you making rash decisions.

As humans, we are prone to be distracted by those who shout loudest. At the moment, that noise is coming from those pesky media sirens who are busy scaremongering and drawing conclusion from just a few months’ data. And whilst yes, there is no doubt about it, the UK’s economy is in a precarious position, dashing your boat on the rocks and selling your investments is unlikely to be the answer.

Investing is a long-term game where patience is a virtue. We shouldn’t be tempted away by short term performances.

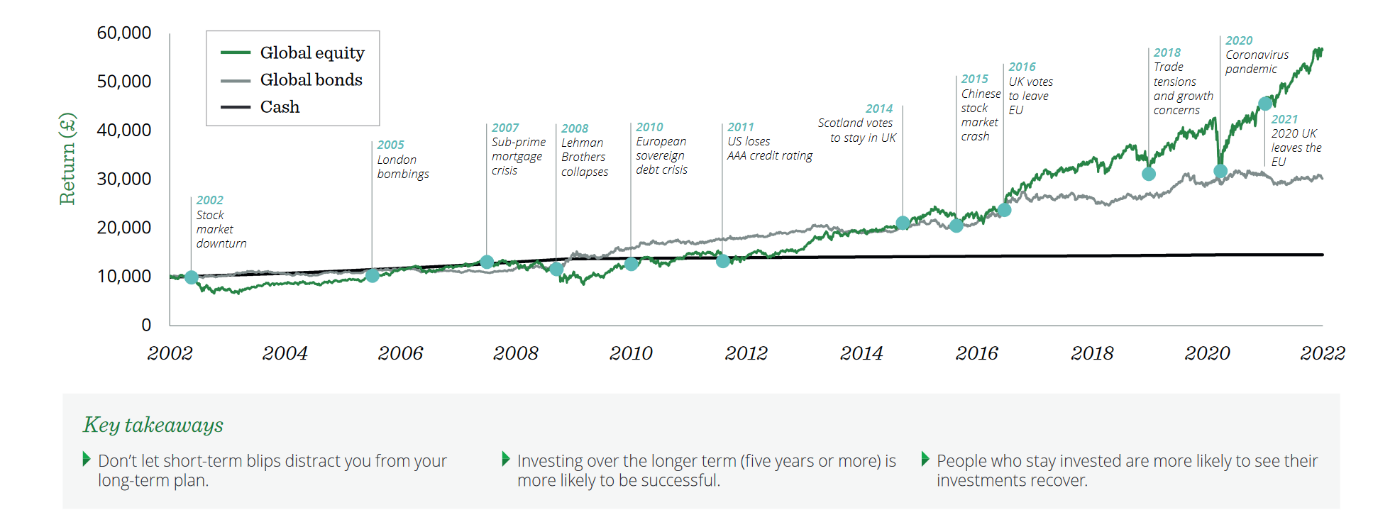

The chart below shows that over the long term, there is an upward trend of returns from equities and bonds, despite the short term volatility caused by major events. In fact, if you had invested £10,000 on 31 December 2000, you could have seen an investment in global equities grow by nearly 500%.

Though short-term volatility in the markets can be disturbing, we should remember that investing always involves an element of risk, which is heightened during periods of turbulence and economic uncertainty. During these times, as we’ve seen in previous periods of volatility, one of the most important things to do is remain focused on your long-term plans. Historically, investors who stayed true to their long-term plans through periods of decline have seen their investments go on to recover and typically prosper.*

The current situation is unnerving. But as a financial adviser, all I can recommend is that if you are worried speak with an expert, such as ourselves. And, in the meantime, don’t crash onto the rocks!

By Daren Wallbank

Past performance is not a guide to future performance and may not be repeated. Investment involves risk.

The value of pensions and investments can fall as well as rise. You may get back less than you invested.

The value of the investment and the income from it can fall as well as rise and investors may not get back what hey originally invested, even taking into account the tax benefits.

*Click here for Investing For The Long Term file

Click here for The Importance of Investing for the-Long Term file